Baby steps to investing for those who don't know how and where to start.

Investing is such a complex and wide topic, with everything ranging from get-quick-schemes to bitcoins to gold to the next housing market boom/crash.

Due to that, one can be tempted to:

spend forever trying to become an expert before dipping a toe into the investment waters, or

leave it to someone else to handle so you don’t have to worry your pretty head of hair over it.

Unfortunately, putting off investing, or shoving it into the hands of somebody else, are both awful ways to go about it.

Just start lah

By putting it off, you are losing out on the best factor when it comes to investing: time.

They say time heals all wounds, but what they forget is that time also makes things grow, and this includes money. You should be investing from your 20s, not when you’re turning 40 or 50.

Start solo, then get help

The easy way out is to just get a professional or your brother-in-law to completely handle your money for you, because who has time for this nonsense??

While I don’t think there is anything wrong in seeking professional help, I also think it is extremely important that you start investing on your own at first. Frankly, nobody will care about your money as much as you do, and by outsourcing it, you are basically missing out on the opportunity to learn, and are instead funding someone else to make mistakes at your expense.

Everyone is different - your priorities and timeline and income trajectory are specific to you. Because of that, you will have a different investment approach than mine or your neighbour’s.

By doing it on your own, you will:

understand your psychological mindset on making money and losing money: are you calm in the midst of an economic downturn or do you panic like a headless chicken?

understand your personal risk profile: how much risk can you handle, and at what point does this make you lose sleep at night?

understand better (if not completely) how the investment tool works, so that when you do end up handing the responsibility over to a professional, you will actually be able to tell if they are doing a good or shitty job rather than blankly nodding along to whatever they say.

Later on, once you’ve gotten a reasonable understanding of how and what you prefer to invest in, and your assets are much more sizeable than they are now, you can consider paying a professional to help you.

By this time, you will know exactly what to look for in a professional, and be able to truly tell if they know what they’re doing or if they’re just talking sweet and fast.

(Even then, I highly recommend keeping a very active finger in how your investments are being managed by the third-party - I repeat, no one will care about your money as much as you do.)

For now, pick up 2-3 books on the topic, or read the first 5 articles that come up on the Google search, and you’re good to start.

“But what if I’m so awful at it and I lose money??”

The thing about being a beginner and a learner is that you will, naturally, be awful at it in the beginning. And yes, as you’re navigating the ropes of ROIs and Sharpe ratios, you may end up losing some money.

But here’s the thing: professional investors lose money too, all the time. It’s part of the game.

But here’s another thing: you will get better, and you will know what to do, or what not to do, and what’s within your control and what’s outside your control. You will still lose money every now and then, because that’s the game, but you will also improve and know what to do to make more money.

Start with the two least complex things on the menu

Here’s the hierarchy of complexity among the different kinds of investments:

For someone who is starting out, I recommend that you first take care of the foundation: savings, emergency fund and insurance if you haven't already.

Then, for investment purposes, go for the two bolded items for starters: bonds and mutual funds - both as a launch pad to more complex investments, but also as a more-than-sufficient investment strategy if you don’t desire to get any more complicated than this.

[This means I will NOT be talking about picking individual stocks, buying real estate or other investment varieties like gold, bitcoin, etc. Some of those require fairly extensive learning and considerable capital, while others work in very specific markets or economies that are unique to it. Not the scope of this post.]

Bonds

Bonds are loans you give to an organisation (typically a government entity), and in return for taking your money for an agreed number of years, they will pay you a % of the amount monthly or annually.

These tend to be the ‘safest’ investment because governments are usually stable and will hardly go bankrupt (although we know that is not necessarily true *coughGreececough*), so it is pretty much guaranteed that you will get the money as promised.

The downside to that is the low returns, that range from only 1-3%.

But hey, it’s stable, it’s relatively low-risk, and is suitable for you if you are more interested in not losing your money than in growing your money. Very very suitable if you do not have the time or the heart to withstand the ups-and-downs yo-yo effect of the other investment tools.

Mutual funds

Mutual funds are groups of individual company stocks compiled by a fund manager. Each fund will have a theme and a set of rules on what they will and will not invest in: for example, an Agriculture Fund will have stocks of agricultural companies, while an Emerging Market Fund will have stocks of companies from the second and third world countries with an anticipated high growth rate.

The main benefit of a mutual fund is the ability to own lots of stocks and even entire industries with a little bit of money, allowing you to spread your risk as you wish.

The main drawback to a mutual fund is the fees (that can go up to 5%) (though not a major deal as you’d be dealing with brokerage fees even if you’re doing on your own anyway). You can offset this drawback by:

opting for index funds if available, with fees as low as 0.2%, or

opting for funds with low fees

***

Baby steps to investing

The following is by no means the only way to do this, but would serve as good pointers on how to get started.

Step 0: Have an Emergency Fund

Before throwing your money at potential investments, make sure you already have your Emergency Fund set up and topped off. This is a very basic step in financial planning, and you can find out more about it in a previous article.

Step 1: Decide on your initial asset allocation

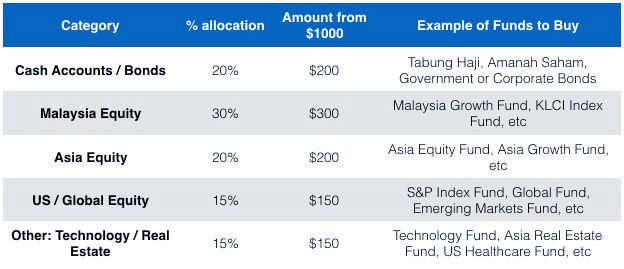

Let’s say, for simplicity, that you have $1000 to invest. How do you want to spread this across your investments? How much will go into bonds, and how much into mutual funds? Within mutual funds, how much will go to which category?

Below is one of many examples of a breakdown of that $1000:

Step 2: Sign up for accounts in fund companies

Once you know how you’re going to spread your money, sign up for an account in your local, trustworthy fund companies. If you’re in the US, I recommend Vanguard. If you’re in Malaysia, try Fundsupermart and skip the fund agents that will gouge out 6% of your money before it even goes anywhere and only pay 2% instead.

Step 3: Put money in and buy

Go through the bond and mutual funds on offer by your fund company of choice. Based on your asset allocation in Step 2, you would already know what categories or themes you want to buy in.

As a start, check for the following:

1. Past performance against comparable funds: IMPORTANT: past performance is not indicative of future performance, so a fund that is performing well does not necessarily mean it will continue to do so. The point of this is to compare similar funds investing in the same industries, and to find out how they have been performing given they are swimming in the same pool - obviously, choose the best swimmer

2. All the fees: in the long run, the fees you are being charged will make a much bigger difference than the performance of the fund, because whether the fund profits or loses money, you still have to pay the fees. Make sure to opt for funds with low and reasonable fees.

Once you get more sophisticated, you can then start checking for things like turnover rates, alphas, betas, R-squareds, and benchmarks. But don't worry about these now, you will get there eventually.

Step 4: Continue to pump money as per your asset allocation, and rebalance twice a year

Your money will hopefully grow, but they will not grow evenly. Some of your investments will do really well and take up a big % of your allocation more than they should, while some will stutter and drop and take up less of your allocation than they should. This needs to be fixed.

Check every 6 months and rebalance: sell some of the well-performing, overly fat investments, and buy more of the under-performing, skinny investments. This is the mutual fund version of ‘buy low, sell high’, but based purely on your asset allocation rules. Read more on asset allocation to learn how to do this in detail.

And that's it.

***

Where to go from here

As mentioned, this is just the start - you can choose to go as complex and as sophisticated as you want. After taking care of the basics listed above, you can take on more expensive investments (like real estate) or explore more esoteric investments (like precious metals or art). Or you can choose to stick with bonds and mutual funds and simply refine your approach.

Either way, go for investments that you are interested to learn about and are interested in monitoring. If you enjoy checking out houses and buildings and love dealing with tenants, you can try real estate. If you don't enjoy being glued to the screen and watching stocks tick up and down, then maybe stay away from trading stocks.

Do not, at any point, go into an investment just because someone else told you to. If you can't be bothered to learn about it, to understand it, and to get better at it, you're not investing, you're speculating.

A good rule of thumb is to keep your adventurous, experimental investing to less than 10% of your holdings. Go crazy, but only by 10%.

***

So, is this going to make you ultra rich soon?

Unfortunately no, The above is not a get-rich-quick-scheme. It will not make you rich beyond your wildest dreams in three months, but you will definitely be richer if you did them than if you didn't.

And if you pair this with sensible money mindsets and practices, then you may even find yourself retiring earlier than expected.

This concludes the series of More Things I Wish You Knew About Money. Check out the entire series, or start at the beginning with Things About Money I Wish You Knew.